XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

So, Zcash is back from the dead.

Just when you thought the crypto graveyard was full, one of the ghosts of 2018 comes rattling its chains, screaming up the charts by over 250%. I had to check my calendar to make sure I hadn't time-traveled. ZEC, the token most people forgot they even owned, is suddenly the talk of the town, ripping past $200. This move prompted headlines that Zcash reclaims $200 level after three years amid renewed interest in privacy coins.

And everyone’s asking the same breathless question: Why?

The official story is a cocktail of institutional interest, influencer hype, and a sudden, passionate rediscovery of financial privacy. It’s a nice, clean narrative. A little too clean, if you ask me. I’ve been in this game too long to believe in fairy tales, and this one smells like a coordinated masterpiece of market manipulation dressed up in a noble cause.

Let's be real. The average person buying `zcash crypto` right now probably couldn't explain what a zk-SNARK is if their life depended on it. They just see a green line going vertical and get a bad case of FOMO.

The crypto market is like a DJ at a wedding that’s gone on three hours too long. The crowd is getting tired, the big hits (Bitcoin, Ethereum) are starting to feel stale, and the DJ is frantically digging through his crate for something—anything—to get people back on the dance floor. He tried the AI tracks, they were fun for a bit. He spun some meme tunes, which got a few people laughing. Now, he's pulled out a dusty record from 2018 labeled "Privacy Coins."

And for a moment, it’s working. The volume on ZEC alone hit over a billion dollars. People are dancing. But is it because they suddenly appreciate the complex choreography of shielded transactions? Or is it just because the beat is loud and the lights are flashing?

The narrative they're selling us is that with governments cracking down and financial surveillance on the rise, people are flocking to privacy-centric assets like `zec zcash`. It sounds good. It’s a powerful story. But I have to ask: how many of the people pumping the `zcash price` today have ever actually used a shielded transaction? I’m willing to bet the number is close to zero. They’re not buying privacy; they’re buying a lottery ticket that’s already started printing winning numbers.

This isn’t a grassroots movement for financial sovereignty. This is a rotation trade, plain and simple. Capital that was in Bitcoin and other majors is taking a breather, and the hot money needs a new home. Privacy is just the story they’re telling themselves to justify the gamble, a phenomenon that has seen Privacy Tokens Zcash, Dash, Railgun Rip Higher as Market Rotates Back to 2018 Narratives.

When you see a pump this aggressive, you don't look for a cause, you look for the culprits. And they aren't hard to find.

First, you have the Wall Street crowd. Grayscale announced a ZEC trust, giving institutional players a "safe" way to get exposure. This is always pitched as validation. "See? The grown-ups are here!" Give me a break. It's just Wall Street finding a new, less-regulated casino to play in. It’s offcourse the same pattern we’ve seen a dozen times. They build the on-ramp for their clients, hype the asset to the moon, and then provide a convenient exit ramp when it’s time to dump on retail.

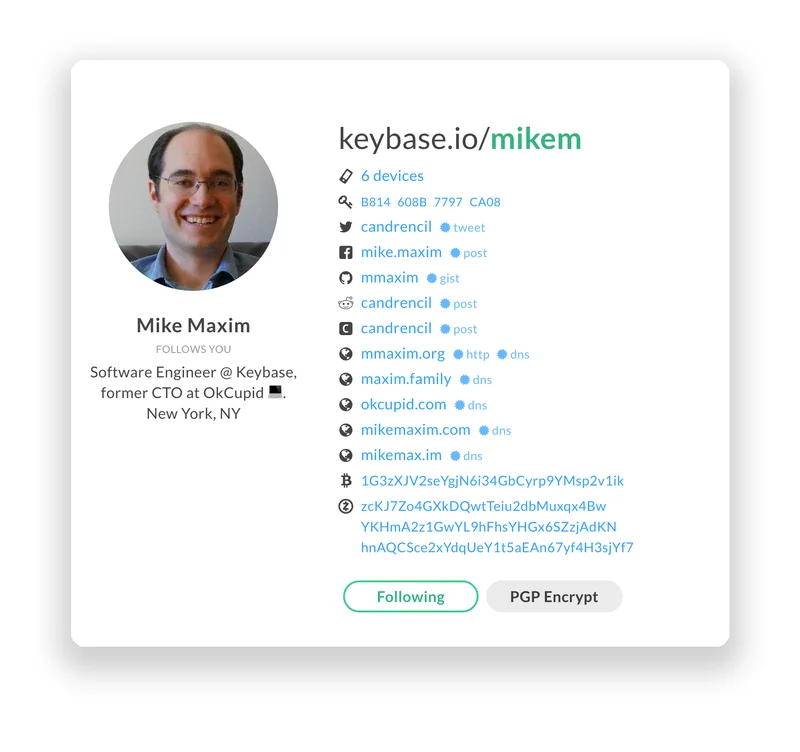

Then you have the influencer brigade. Venture capitalist Naval Ravikant calls Zcash "insurance against Bitcoin." It’s a fantastic soundbite. It's also a perfect piece of marketing to convince people they need to add another speculative asset to their portfolio. It’s a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of recycled narratives. These guys aren't prophets; they're marketers. They know that in a bull market, you don't need fundamentals. You just need a good story and a big enough megaphone.

They're selling a revolution, but all I see is a price chart that looks like a terrified cat jumped on a keyboard. And we all know how that story ends...

And don't even get me started on the tech itself. The Zashi wallet, with its cross-chain swaps, is cool, I guess. But that technology has been developing for years. The sudden 400% price surge ain't because a few more people downloaded a wallet app. It's because a tidal wave of speculative cash just crashed onto a very small beach.

Before you remortgage your house to `buy zcash`, maybe zoom out on the chart. Way out. Despite this insane rally, ZEC is still down more than 90% from its all-time high of over $3,000 back when crypto was truly the Wild West. This isn't a glorious comeback; it's a dead cat bouncing on a trampoline.

There's an old trader heuristic that a massive Zcash pump is a warning sign—a kind of canary in the coal mine signaling that the broader market, including `bitcoin`, might be hitting a local top. It’s the moment when the dumbest money starts chasing the most forgotten coins, a classic sign of late-stage euphoria.

I don't know if that's true this time, but it feels right. It feels like the final, frantic phase of a party right before the lights come on and everyone realizes how messy the room is. Then again, maybe I'm the crazy one here. Maybe this time really is different.

But history rarely lies. The fundamentals for Zcash haven't meaningfully changed in the last 30 days. What changed is the narrative. And narratives are as fickle as the market itself.

Let's cut the crap. This isn't about privacy. This is a liquidity-fueled rotation trade into a forgotten corner of the market, propped up by a convenient story that makes speculators feel like they’re part of a movement.

The interest in Zcash isn't driven by a sudden societal awakening to the virtues of financial privacy. It's driven by greed, pure and simple. It's about finding an asset that's still got room to run and pumping it with everything you've got.

Enjoy the ride. Make some money if you can. But don't for a second fool yourself into thinking you're a financial revolutionary. You're just a gambler at a table that's gotten incredibly hot. Just make sure you have a chair when the music stops. Because it always, always stops.