XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

So Zcash is having a moment. I see the headlines, I see the posts on X, and I see the FOMO dripping from every corner of the crypto space. The price chart looks like a damn rocket ship, blasting from fifty-something bucks to over $370 in a month. Everyone who got in early is a genius, and everyone on the sidelines is feeling that familiar, sickening pang of regret.

Arthur Hayes, the crypto oracle himself, throws out a casual "$10,000" price target in a "vibe check," and the market loses its collective mind. Zcash pumps 30% after Arthur Hayes’ ‘vibe check’ tips $10K target because... a guy had a vibe.

Let's be real. This isn't about fundamentals. This is a story. And right now, it's a damn good one.

You’ve got a "perfect storm of catalysts," as one CEO put it. A halving event is coming in November, which is crypto-speak for "the supply is about to get tighter, so you better buy now!" You’ve got big-shot investors like Naval Ravikanth giving it the nod. And you’ve got this overarching, romantic narrative about privacy in an age of ever-increasing surveillance. It all sounds so compelling, so urgent.

It’s the financial equivalent of a blockbuster movie trailer. Quick cuts, loud music, big explosions. It gets your heart racing and makes you want to buy a ticket. But what happens when you actually sit down and watch the whole movie?

The narrative is simple and seductive: The world is becoming a surveillance state, and privacy is the new gold. Zcash, an old-school privacy coin, is here to save the day. It’s an easy, liquid way for traders to bet on this theme. Add in a halving event to juice the scarcity story, and you've got a recipe for a speculative frenzy.

This whole thing feels like one of those restored classic cars you see at an auction. It’s got a gleaming new paint job, polished chrome, and it roars to life when the auctioneer turns the key. It looks incredible from 20 feet away. Everyone oohs and aahs. But what they don't tell you is that the engine is prone to overheating and the transmission is held together with duct tape and a prayer.

The Zcash rally is that car. The shiny paint is the price chart. The roaring engine is the influencer hype. But are we really supposed to ignore what’s under the hood?

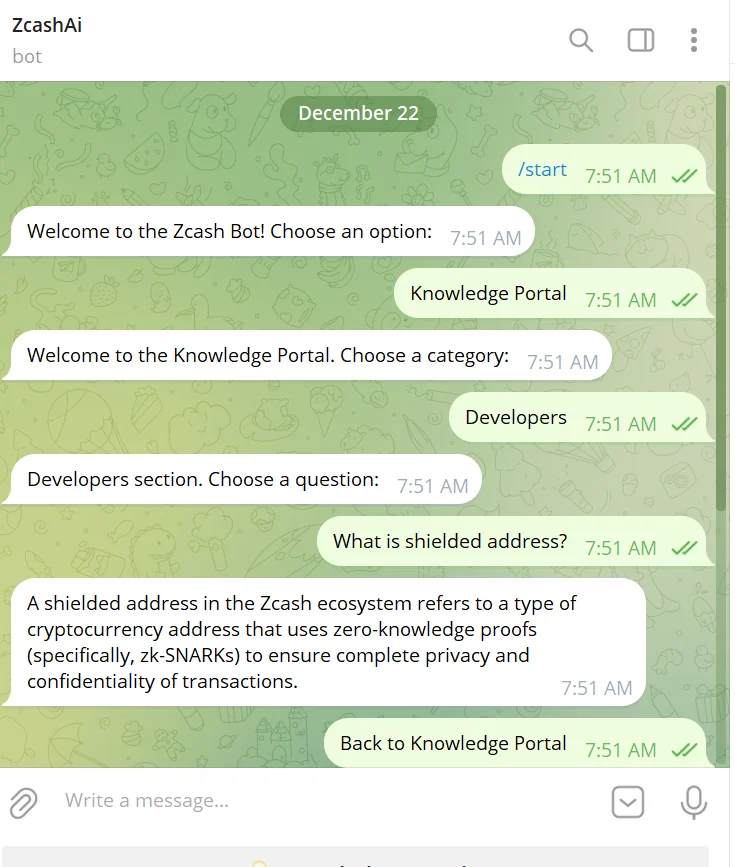

Because when you start asking basic questions, the whole thing gets a little shaky. The core promise of Zcash is its "shielded transactions"—the ability to send and receive money privately. So, with this massive price surge and renewed interest in privacy, you’d expect the use of that feature to be going through the roof, right? Well, one analyst pointed out that there’s been a "limited increase" in shielded transactions.

Wait, what? The coin's primary feature, its entire reason for existing, isn't seeing a corresponding boom in usage? It's like a waterproof watch company seeing its stock price triple while its own employees admit nobody's actually taking the watches swimming. What does that tell you?

It tells me this isn't about utility. It's about momentum. It's a game of hot potato with digital tokens, and nobody wants to be the one holding the bag when the music stops.

Let's dig deeper. Zcash’s privacy is optional. That’s a design choice, but it’s a critical one. Most people, out of convenience or ignorance, just transact on its public ledger. This undercuts the entire network's differentiation. A privacy network where most people don't use the privacy features is just... a network.

This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of a thesis if you're betting on long-term adoption. You're buying into a promise that the product's own users are largely ignoring.

And then there's the big, ugly elephant in the room: regulators. Financial watchdogs hate privacy coins. They see them as tools for money laundering and illicit activity. That's why Zcash and its cousin Monero are constantly getting delisted from major exchanges. How can an asset achieve mass adoption when the main on-ramps and off-ramps are actively trying to kick it out the door? It’s like trying to build a global shipping empire when every major port authority has a picture of your CEO on a "Do Not Admit" poster.

Honestly, this is the part of crypto that drives me insane. The endless cycle of hype over substance. We have Ethereum, which, for all its flaws, is a bustling digital metropolis. It has an $86 billion DeFi ecosystem. It's becoming the default settlement layer for tokenized real-world assets like U.S. Treasuries. It has economic value. Zcash has... a story about privacy and a halving. They want you to believe this is the future of private digital cash, and I just...

Compare the two. One is a functioning, if chaotic, economy. The other is a speculative bet that a feature most people don't use will suddenly become the most important thing in the world, all while dodging a global regulatory crackdown. Which one sounds like a better long-term investment to you? Offcourse, the one that goes up 500% in a few months is more exciting, but excitement and sustainability are two very different things.

Then again, maybe I'm the idiot. Maybe the story is all that matters. In a market driven by memes and vibes, maybe a $10,000 price call from a guy on X is the only fundamental you need.

Nah.

The halving is set for November 18. The hype will likely build until then. The price could absolutely go higher. Shorting this kind of momentum is a fool's errand. You could make a lot of money riding this wave.

You could also get completely, utterly wiped out.

This rally is pure speculation. It's a narrative trade. When the halving happens, the narrative reaches its climax. What happens then? The classic "sell the news" event, where all the traders who bought in on the rumor cash out, leaving the latecomers holding a rapidly depreciating asset.

The sustainability of this pump hinges entirely on whether real user growth follows the speculative frenzy. Can the privacy narrative actually convince millions of people to start using shielded transactions? Can it overcome the regulatory hurdles? Can it build a real ecosystem beyond just being a token on a chart that goes up and down?

I have my doubts. Serious ones. This feels less like the dawn of a new era for privacy and more like a classic altcoin pump fueled by easy money and a compelling, but ultimately hollow, story. Watch it, trade it if you must, but don't mistake a casino for a sound investment.

Let's cut the crap. This isn't a revolution. It's a trade. A mob of speculators, whipped into a frenzy by a few influential voices, is chasing a hot dot on a screen. The "privacy narrative" and the "halving" are just socially acceptable excuses to justify the gamble. The real goal is to buy high and sell higher to the next person in line. Don't fool yourself into thinking you're an early adopter in a new financial paradigm. You're the person they're planning to sell to right before the music stops.