XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

So the IRS dropped its 2026 tax bracket adjustments, and the usual crowd of personal finance bloggers are falling all over themselves to tell you the "good news." You can practically hear the frantic typing, the clinking of an ice cube in a glass of lukewarm tap water as they rush to publish their explainers.

Good news? Give me a break.

This isn't good news. This is the bare-minimum, legally-mandated maintenance on a system designed to slowly bleed you dry. It’s like the landlord of your overpriced apartment showing up to replace a single burnt-out lightbulb in the hallway and expecting a thank you note. Meanwhile, the roof is still leaking and the rent just went up another 8%.

Let’s be real. The government, through the IRS, is telling you they’re graciously allowing you to keep a tiny sliver more of your own money to offset the inflation they had a hand in creating. And we're supposed to be grateful?

Every year, we go through this same tired ritual. The headlines blare that the IRS announces new federal income tax brackets for 2026, all to prevent something called "bracket creep." It sounds technical, but it’s simple. Bracket creep is when a modest cost-of-living raise—the kind that barely lets you keep pace with the rising price of eggs—pushes you into a higher tax bracket. Suddenly, you’re paying more in taxes even though your actual purchasing power hasn't changed a bit. You’re running in place on a financial treadmill, and the government just cranked up the speed.

So, these annual adjustments are supposed to fix that. For 2026, the adjustment is a whopping 2.7%. For a single filer, the standard deduction is going up by $350. For a married couple, it’s $700.

Wow. Seven hundred bucks. That’s maybe a month’s worth of groceries, if you're lucky and stick to store brands. Or half a car payment. This isn’t a tax break; it’s a rounding error. It’s the political equivalent of finding a crumpled five-dollar bill in last year’s winter coat. It’s nice for a second, but it changes absolutely nothing about your financial reality.

This whole process is a masterclass in misdirection. The tax code is an elaborate machine with thousands of moving parts, and these bracket adjustments are the squeaky wheel that gets the grease. The government makes a big show of oiling it once a year so we don't notice the engine is on fire. They want us to focus on the flashy dials and ignore the fact that the entire vehicle is driving us off a cliff. Why aren't we asking the more fundamental question: why is the system designed this way in the first place? Why are we celebrating not being punished for inflation?

And then there's the legislation that locked all this in place: the "One Big Beautiful Bill Act," or OBBBA.

You can't make this stuff up. It sounds like something a megalomaniacal real estate developer would name his pet project. Seriously, what focus group of out-of-touch D.C. staffers came up with that? It's just another example of wrapping a deeply mediocre piece of policy in a shiny, patriotic bow. It’s like putting lipstick on a pig. No, that's not right—it's like putting lipstick on a feral hog that's currently trying to eat your wallet.

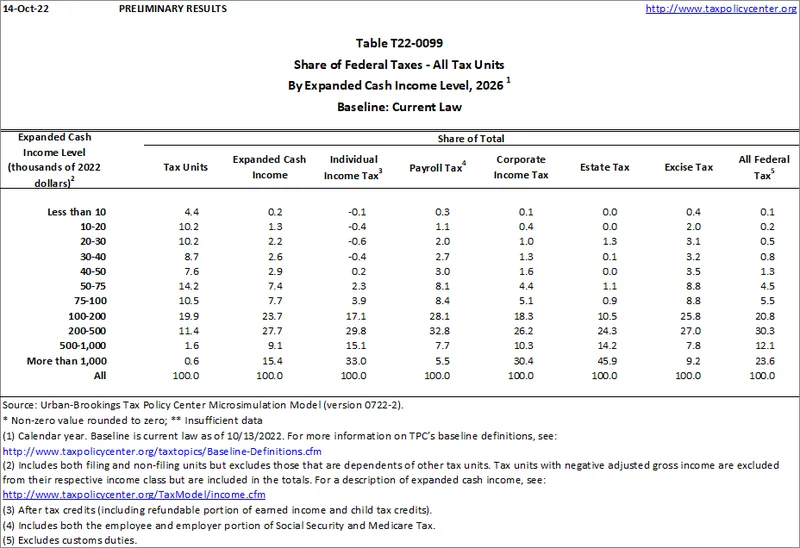

The OBBBA kept the current tax rates from reverting to the higher, pre-2017 levels. Okay, fine. Nobody wants their rates to go up. But look at what else it did. For folks in the top 37% bracket, it slapped a new 35% cap on their itemized deductions. So instead of getting 37 cents back on the dollar for their deductions, they now get 35. It’s a subtle claw-back, a little sleight of hand to make sure the house still gets its cut.

This is the game. They give with one hand and take with the other, all while smiling for the cameras and talking about how much they’re helping the American people. They nudge the standard deduction up a bit for the masses, which feels like a win, but then they tweak the rules for Health Savings Accounts, estate taxes, and gift tax exclusions—things that overwhelmingly benefit people who have accountants on retainer. The lifetime estate tax exclusion is jumping to $15 million. How many people do you know who are worried about their $15 million estate? Offcourse, not many.

They sell it all under this ridiculous, comically oversized banner of a "Big, Beautiful Bill" and expect everyone to just cheer. And the sad part is, most people are too busy trying to figure out how to pay their bills to notice the fine print. They see a headline that says "Standard Deduction Increased," and they think, "Great, I guess." They don't have time to dig into the 36-page IRS release, and honestly, who can blame them...

Then again, maybe I'm the crazy one. Maybe a few hundred bucks is a big deal, and I’m just too cynical to see it. But it feels less like a helping hand and more like a pat on the head while someone else picks your pocket.

Look, here’s the bottom line. These annual tax adjustments aren't a gift. They are a feature, not a bug, of a system designed to be just complicated enough that you can't ever truly get ahead. It's a system that thrives on complexity, on obscure rules and last-minute "beautiful" bills that nobody has time to read. The small bump in your standard deduction is a calculated distraction, a pittance designed to keep you placated while the fundamental math of wages vs. cost-of-living continues to screw you over. Don't thank them for it. Demand better.