XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

The headlines flashing across our screens this week feel disjointed, almost chaotic. In one corner of the world, the United States Treasury is buying up a collapsing currency in South America. In another, it's using massive tariffs to force one of the world's largest democracies to change where it buys its oil. On the surface, these are just aggressive foreign policy moves. But I urge you to look closer. I don't believe we're just watching politics as usual. We are witnessing the beta test of a new global operating system.

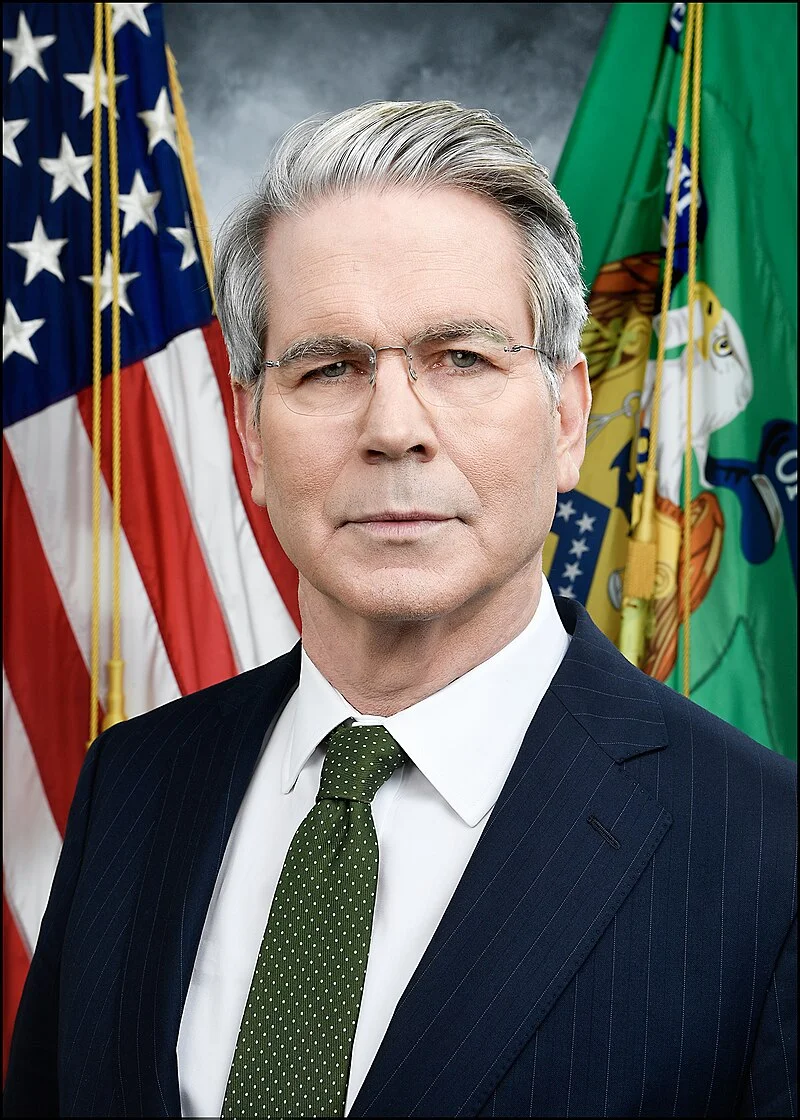

What connects the high-stakes drama in Argentina with the trade pressure on India isn't just a shared administration; it's a shared philosophy. And the chief architect of this new system appears to be Treasury Secretary Scott Bessent. This is a man who didn't come from the slow, deliberative world of diplomacy. He made his name as a currency trader, a veteran of the infamous "Black Wednesday" that broke the Bank of England. He doesn't think in terms of treaties; he thinks in terms of trades. He sees leverage, risk, and arbitrage where others see relationships. And he’s now applying that high-frequency trader's mindset to the entire planet.

This isn't just a policy shift. It's a fundamental change in the language of power. We're moving from a world governed by drawn-out negotiations and diplomatic communiqués to one driven by the immediate, binary logic of the market. And frankly, we are not ready for the speed at which this new reality is unfolding.

Let's start with Argentina. The country is in a tailspin, its peso cratering, and its pro-American, free-market president, Javier Milei, is facing a political crisis. The old playbook would involve months of negotiations with the IMF, conditional loans, and a slow, painful recovery process. The new playbook? The US Treasury steps in directly. The Treasury Secretary's office announced that Bessent says US purchased pesos and finalized framework for $20 billion lifeline for Argentina—in simpler terms, a massive, instantly accessible credit line allowing Argentina to trade its unstable pesos for solid US dollars.

Imagine a surgeon bypassing the entire hospital administration and scrubbing in to perform a life-saving operation themselves. That’s the level of direct intervention we’re seeing. Bessent calls it providing "stability to markets" and ensuring the success of a key ally. Critics, like Senator Elizabeth Warren, call it a misuse of taxpayer money, asking why we’re buying pesos when Americans need healthcare. But I think both are missing the bigger picture.

This isn't a bailout in the traditional sense. It's a strategic acquisition. The US is using the dollar not as the world's reserve currency, but as a surgical instrument to excise political instability and lock in an ideological ally. It’s a move straight from a hedge fund playbook: find an undervalued asset (a strategically important but financially weak country), inject capital to prevent a total collapse, and in doing so, secure immense influence and a favorable outcome. When I first saw the news, I honestly just sat back in my chair, speechless. The sheer audacity of it is breathtaking. It raises a profound question: what does it mean when a nation's sovereignty can be stabilized with a wire transfer from another country's treasury? Are we creating allies, or are we creating dependencies that operate at the speed of the market?

Now, pivot to India. For years, India has been a master of geopolitical non-alignment, skillfully balancing its relationships with the US, Russia, and China. A key part of that strategy has been its purchase of discounted Russian oil, which Washington argues is funding the war in Ukraine. The old approach would be sanctions, diplomatic pressure, and endless rounds of talks. The new approach is far more brutal and far more direct. The Trump administration slapped a staggering 50% tariff on most Indian exports.

This isn't a negotiation; it's the flipping of a switch. The message is simple: you can have access to the American market, the largest consumer market in human history, or you can have Russian oil. You can't have both. The critical data point here is the Treasury Secretary's claim that India set to buy less Russian oil, more US crude in coming months, claims Treasury Secretary Scott Bessent. The speed of this cause-and-effect relationship is the real paradigm shift—it means that global supply chains, which once took decades to build, can now potentially be rerouted in a matter of months with a single, powerful economic lever.

This is a change as fundamental as the invention of the telegraph, which collapsed the time it took for information to cross oceans. We are witnessing the collapse of diplomatic latency. Bessent isn't just trying to influence India; he's demonstrating a new form of power that is immediate, transactional, and shockingly effective. Of course, this raises an uncomfortable ethical question. Wielding economic power with this level of force is like using a sledgehammer in a room full of priceless vases. What are the unintended consequences? What happens to the global system when the primary tool of statecraft is no longer the diplomat's pen, but the trader's terminal?

What we're seeing in Argentina and India aren't separate stories. They are the first live demonstrations of a new doctrine of power, a kind of "Geofinance" where the instruments of the market have become the primary weapons of the state. It's a world where alliances are secured with currency swaps and geopolitical alignment is enforced by tariffs. This is a system that values speed and leverage above all else. It's breathtakingly powerful, deeply disruptive, and it is being built right before our eyes. The old maps of diplomacy are being rolled up. We are entering a new age, and we had better learn its rules, fast.