XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

Rocket Lab’s 44% Surge: A Sober Look at the Numbers Behind the Hype

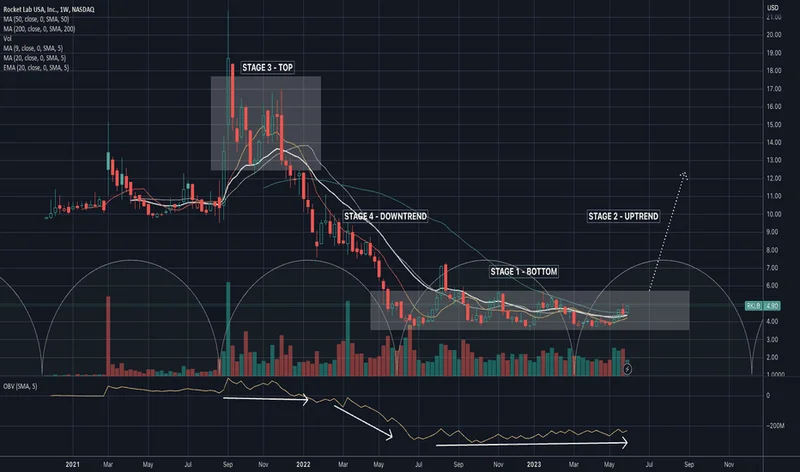

The market has a new darling in the space sector, and its name is Rocket Lab. The stock (RKLB) has been on an absolute tear, posting a gain of 43.86% over the last month alone. The narrative is simple and seductive: this is the agile, small-satellite specialist carving out a lucrative niche while everyone remains mesmerized by SpaceX’s heavy-lift dominance. The recent flurry of contract announcements, particularly from Japan, has sent investor sentiment into overdrive.

But sentiment doesn’t pay the bills, and narratives don't build rockets. My job is to look past the breathless headlines and examine the cold, hard data. When a stock moves this far, this fast, it’s essential to ask whether the underlying business fundamentals have truly changed, or if the market is simply pricing in a decade’s worth of flawless execution in a single quarter. Let's disconnect from the hype and connect to the numbers.

The catalyst for this recent rally is a cascade of contract wins that, on the surface, look incredibly impressive. The latest is a direct deal with JAXA, Japan's national space agency, for two dedicated launches on the company's workhorse Electron rocket. This follows an expanded multi-launch agreement with Japanese Earth-imaging firm iQPS and, most significantly, the company’s largest-ever deal: a 10-launch contract with Synspective signed back in June.

Let’s quantify this. Rocket Lab has effectively become the go-to launch provider for Japan’s burgeoning commercial and governmental space sector. The Synspective deal, running from 2025 to 2027, is particularly noteworthy. I've looked at hundreds of these long-term supply agreements, and the progression here—from being Synspective's sole launch provider since 2020 to securing a 10-launch block buy—is a powerful indicator of customer dependency and operational trust. This isn't a speculative pilot program; it's a deep, structural integration.

This backlog provides a degree of revenue visibility that is rare for a company in this high-growth, high-risk industry. We can see a clear path for its launch cadence, which has accelerated from six launches in 2021 to a projected 20-plus for the full 2025 calendar year. That is undeniable operational momentum.

But this concentration also raises a critical question that the market seems to be ignoring. By embedding itself so deeply within a single nation's space ecosystem, has Rocket Lab inadvertently created a geographic concentration risk? What happens if Japan’s national space strategy or budget priorities shift in the coming years? A strength can quickly become a vulnerability if the environment changes. The market is currently rewarding this focus, but a prudent analyst must consider the potential downside of having so many eggs in one basket, however strong that basket may seem today.

For all the top-line excitement, the financial reality on the ground is more complicated. Rocket Lab’s revenue growth is, without question, spectacular. The company's revenue grew at a compound annual rate of roughly 85% from 2021 to 2024—to be more exact, it was an 87.4% CAGR. Its adjusted gross margin has also steadily expanded, from 16.3% in 2021 to 35.2% in the first half of 2025, suggesting economies of scale are beginning to take hold. Many consider it The Smartest Growth Stock to Buy With $1,000 Right Now.

This is where the good news pauses. The company remains unprofitable on a GAAP basis, and its adjusted EBITDA is still negative. Analysts project it might turn EBITDA-positive in 2026, but that is still a projection, not a reality. The market is paying a premium today for profits that are still years away.

This brings us to the biggest variable in the entire Rocket Lab thesis: the Neutron rocket. The Electron has been a triumph, a reliable vehicle that created the small-launch market as we know it. But the company's future, and its current lofty valuation, is inextricably tied to the success of Neutron. This is the company's play for the big leagues. To use an analogy, the Electron is the reliable, fuel-efficient sedan that built the company's brand and cash flow. The Neutron is the heavy-duty commercial truck they've promised to build, which is supposed to unlock an entirely new, more profitable market segment.

The current stock price seems to assume the truck factory is already built, certified, and running at full capacity. A multi-launch contract for Neutron was announced in December 2024 with a confidential customer, which is certainly a vote of confidence. But it’s confidence in a vehicle that has yet to fly. The Neutron is designed for much larger payloads (up to 13,000 kg), putting it in a different competitive class and introducing entirely new engineering and logistical challenges. How much of the current $32 billion market cap is based on the proven success of Electron versus the unproven promise of Neutron? My analysis suggests it's far more of the latter than the market wants to admit.

So, what is the final calculus here? The operational execution with the Electron rocket is undeniable, and the strategy to dominate the Japanese launch market has been brilliantly executed. The revenue growth and margin expansion are real and provide a solid foundation.

However, the current valuation is no longer grounded in that reality. It is a valuation built on the future tense. It assumes the launch cadence continues to accelerate without a hitch, that margins will keep expanding on schedule, and, most critically, that the transition to the much larger and more complex Neutron rocket will be seamless. In the world of aerospace, seamless transitions are exceedingly rare.

The constant comparisons to SpaceX are both a blessing and a curse. They provide a valuation anchor in the minds of investors, but SpaceX is a private, diversified behemoth with Starlink, a cash-generating machine. Rocket Lab is, for now, a pure-play launch and space systems company. Trading at 23 times its projected sales for 2027, the stock is priced for perfection. The risk has been transferred from the business to the balance sheet. After a 44% run-up, the question is no longer whether Rocket Lab is a good company. The question is whether it's a good stock at this price. The numbers suggest the margin of safety has all but vanished.