XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

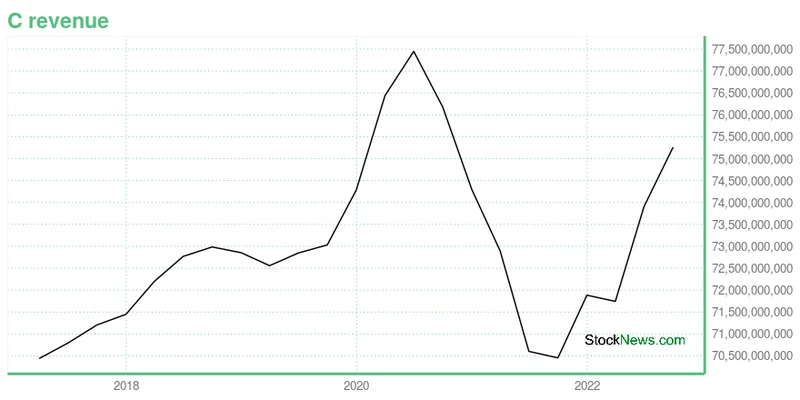

The market loves a simple story. On October 14, Citigroup delivered one, gift-wrapped for investors: a stellar third quarter where, as one headline put it, Citi reports a rise in earnings with every business posting record third-quarter revenue. The press release was clean, the conference call was confident, and the top-line numbers were unambiguous. It’s the kind of report that makes for easy, positive headlines and justifies a nice little bump in the stock price.

But in my experience, the simplest stories are often the most misleading. When a company’s narrative is too perfect, my first instinct isn’t to applaud; it’s to check the footnotes. The real story of a company isn’t just in its income statement, which measures a single quarter’s sprint. It’s in the balance sheet, the document that tracks the long, grueling marathon. And when you look at Citigroup’s marathon pace, the picture becomes significantly more complicated. The Q3 earnings report isn't a story of unvarnished success; it’s a paradox. It’s the tale of a company running faster than ever while simultaneously taking on an alarming amount of weight. The question is, which of those two forces will win out?

Let's start with the numbers Citigroup wants you to focus on. A three-year revenue growth rate of about 7%—to be more exact, 6.7%—is respectable for a financial institution of this size. It suggests a steady, reliable engine. The reported net margin of 17.06% is healthy, indicating that the company is, on paper, efficiently converting revenue into profit. In a vacuum, these are solid metrics. They paint a picture of a well-oiled global machine, firing on all cylinders across its 100-plus country footprint.

This is the narrative that supports the current valuation. With a Price-to-Earnings (P/E) ratio of 14.44 and a Price-to-Sales (P/S) of 2.25, both hovering near their five-year highs, the market has clearly bought into this growth story. The analyst consensus, with a target price north of $110, reinforces this sentiment, with some arguing that Citigroup Stock Has Room To Run After Earnings (NYSE:C). From a distance, everything appears aligned for a continued run.

But this perspective is like admiring a skyscraper from a helicopter. The architecture looks stunning, the glass gleams, and its height is impressive. You only see the structural stress when you go down to the foundation and check for cracks. And this is the part of the report that I find genuinely puzzling: the sheer disconnect between the celebratory tone of the earnings call and the stark, mathematical reality of the balance sheet. What is funding this impressive growth? The answer should give any serious investor pause.

Here is the number that matters most: 1.75. That’s Citigroup’s debt-to-equity ratio. For a financial institution, some leverage is normal, but this figure points to a high degree of it. It’s not an isolated metric, either. The company has been actively piling on debt (a staggering $59.4 billion in new issuances over the past three years). This isn't just maintaining leverage; it's aggressively increasing it.

Think of it like this: Citigroup is a world-class athlete posting personal-best race times. But instead of attributing it to a better training regimen, we discover they’ve been taking on massive amounts of stimulants. The performance is real, but it’s artificial and comes with a heavy, unseen cost to the body’s long-term health. The revenue growth is the race time; the $59.4 billion in new debt is the stimulant. How long can that performance be sustained before a collapse?

This isn't just my interpretation. The Altman Z-Score, a formula designed to predict bankruptcy, flags Citigroup for "poor financial strength," citing the high debt levels as the primary culprit. While bankruptcy is an extreme scenario for a systemically important bank, the score is a powerful indicator of underlying financial fragility. It tells us the foundation is under strain.

Compounding this quantitative concern is a telling qualitative signal: insider activity. Over the last year, there have been 10 insider sell transactions. Corporate executives are, by definition, the most informed market participants regarding their own company's health. When they broadcast confidence on a conference call but are quietly, consistently selling their own shares, it creates a significant discrepancy. What do they see in the long-term data that makes them unwilling to hold on for the ride? Are they cashing in on a valuation they know is propped up by a risky, debt-fueled strategy?

Ultimately, my analysis leads me to a single, unavoidable conclusion. Citigroup is presenting one story to the public via its income statement while a very different, more troubling story is being written on its balance sheet. The record revenues are real, but they are financed by a level of debt that introduces significant systemic risk. The market, fixated on the shiny top-line numbers, appears to be mispricing this risk entirely, pushing the valuation to a peak just as the foundational cracks are beginning to show. The current stock price seems to reflect the athlete’s record speed, not the dangerous stimulants required to achieve it. For my money, that’s a bet I’m not willing to take.