XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

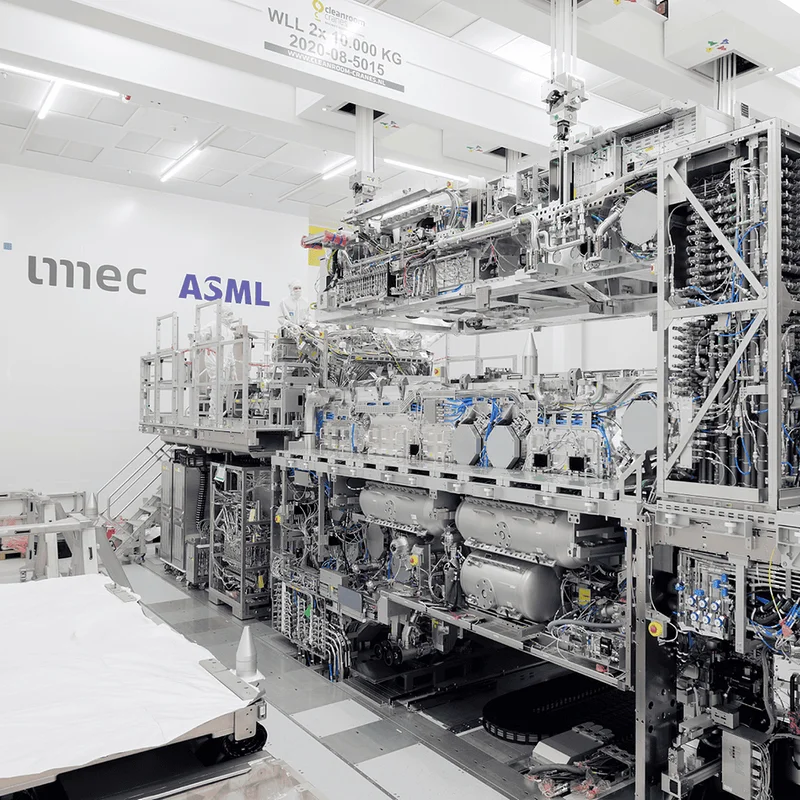

In the intricate world of semiconductor manufacturing, ASML is not just a participant; it's the foundational layer upon which the entire modern digital economy is built. The Dutch firm holds an absolute monopoly on the extreme ultraviolet (EUV) lithography systems required to produce the world's most advanced chips. Every major player—TSMC, Samsung, Intel—relies on its machines. This unique, unassailable position makes it the ultimate "picks and shovels" play in the gold rush for AI compute power.

The market has certainly priced it as such. After a sluggish start to 2024, the stock has been on a tear, fueled by a narrative of relentless AI-driven demand. But a closer look at the data reveals a significant tension. On one side, you have a spectacular, V-shaped recovery in earnings and sales. On the other, you have a storm of geopolitical headwinds and a valuation that leaves absolutely no room for error. The company’s upcoming earnings report on October 15th is shaping up to be a critical stress test, boiling the entire investment thesis down to a single question: Is ASML Stock a Buy Before Oct. 15? The question isn't just whether the past quarter was good, but whether the glowing future priced into the stock is still mathematically plausible.

To understand the market's current optimism, you have to look at the whiplash of the last 18 months. After a blistering 30% surge in net sales in 2023, ASML hit a wall in early 2024. Net sales growth slowed to a mere 3%, and earnings per share actually declined. The slowdown was a cocktail of tough comparisons against the initial AI boom, softening demand for non-AI consumer electronics, and, most critically, escalating export restrictions to China. For a moment, the giant looked vulnerable.

Then came the rebound. The recovery, when it arrived, was ferocious. Look at the year-over-year quarterly numbers. After contracting 9.5% in Q2 2024, net sales growth accelerated sequentially through the next three quarters, hitting a staggering 46.4% in Q1 2025. The earnings-per-share growth was even more dramatic. After an 18.7% decline, it exploded to a massive gain of around 93%—to be more exact, 92.9%—in the first quarter of this year.

This reversal was driven almost entirely by the insatiable demand for high-bandwidth memory (DRAM) and logic chips essential for AI data centers. As companies like Nvidia scramble for every last bit of production capacity, the foundries are turning to ASML for the tools to make it happen. This is the bull case in its purest form: ASML is the sole gatekeeper to the AI revolution, and the gate is wide open. Analysts have extrapolated this trend forward, forecasting a compound annual growth rate of 10% for revenue and 16% for EPS through 2027. It's a pristine picture of predictable, monopolistic growth.

The problem with pristine pictures is that they are often painted in a vacuum. Inside ASML's facilities, technicians in sterile bunny suits assemble machines with nanometer precision. Outside, the world of geopolitics operates with all the precision of a sledgehammer, and that is where the consensus forecast starts to look fragile.

The primary risk factor is, and has always been, China. The company is already barred from selling its most advanced EUV systems to China (a restriction that has been tightening over time), but it has still been able to ship a significant number of its less-advanced, but still highly profitable, DUV systems. That revenue stream is now under severe threat from both sides of the Pacific. The U.S. government continues to broaden its definition of what constitutes "advanced" technology, while Beijing has demonstrated its willingness to retaliate by restricting exports of critical materials like rare earth elements.

I've looked at hundreds of these geopolitical risk statements in corporate filings, and the situation with ASML is unique. It's not just a company caught in the crossfire; its technology is the very territory being fought over. This makes its guidance on China sales more than just a line item; it's a barometer for the entire tech cold war. How can a company confidently project a decade of smooth growth when one of its largest and most profitable markets could be curtailed by a presidential tweet or a Politburo decree?

This brings us to valuation. At 34 times next year's earnings, the stock isn't just expensive; it’s priced for perfection. That multiple assumes the AI tailwinds will continue unabated and that the geopolitical risks will somehow be neatly contained. It also seems to discount the rising costs associated with rolling out the next generation of "high-NA" EUV systems, a massive capital expenditure. If management is forced to rein in its sales forecasts even slightly on October 15th, or signals that margins are being compressed by the high-NA ramp-up, there is very little valuation support to cushion the fall. The market has priced in the monopoly, but has it fully priced in the burden that comes with being the world's most critical technological chokepoint?

My analysis suggests the narrative has outrun the numbers. ASML is a phenomenal, world-changing company with a moat that is less a moat and more a continental divide. That is not in dispute. What is in dispute is whether the current stock price adequately reflects the immense and growing external pressures on its business model. The market is paying for a monopoly and for flawless execution in an increasingly chaotic world. That's a dangerous combination. The October 15th report is therefore less about celebrating the past quarter's AI-driven success and more about scrutinizing management's ability to navigate a future where its biggest customer and its biggest geopolitical threat are the same entity. I'm not a seller of the company, but at this valuation, I'm certainly not a buyer before hearing how they answer that question. The risk is simply skewed to the downside when the price already reflects a perfect outcome.