XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

Yesterday, something happened that financial analysts will spend weeks dissecting in terms of share price and earnings per share. They’ll talk about Microsoft’s stock jumping 4%, the intricacies of the Dow Jones Industrial Average, and whether a stock split is imminent after two decades. And they will, with all due respect, be missing the point entirely. What we witnessed wasn’t just a deal. It was a formal declaration of a new kind of existence.

When I first read the announcement—that Microsoft had cemented a new agreement valuing its stake in OpenAI at a staggering $135 billion—I honestly just sat back in my chair, speechless. Forget the numbers for a second. Try to picture the room where this was signed. This wasn't a typical acquisition. This was a pact. A covenant. On one side of the table, you have one of the largest, most powerful corporations in human history. On the other, you have the stewards of what is arguably the most potent, world-altering technology since the splitting of the atom. Microsoft now holds a 27% stake in what comes next for humanity.

This isn’t like buying a factory or a software company. This is like buying a stake in the invention of fire. The details that matter aren't in the stock tickers; they're buried in the contractual language. Microsoft's intellectual property rights are now extended through 2032 and—this is the part that should send a shiver down your spine—include models developed after Artificial General Intelligence (AGI) is achieved.

Let that sink in. They have contractually planned for the moment the machine wakes up. So, what does it truly mean to own a piece of an intelligence that doesn't fully exist yet, but is being willed into existence by the brightest minds of our generation? Are we just watching a smart investment, or are we witnessing the legal and financial framework being laid for the first true human-AI symbiosis?

To understand the magnitude of this, you have to stop thinking of OpenAI as just a product company. It’s not. It’s an R&D lab birthing a new form of cognition. Microsoft’s relationship with it is less like a car company buying a tire supplier and more like a brilliant shipwright forming a partnership with the ocean itself. The shipwright can design the vessel, provide the materials (in this case, Azure’s massive computing power), and steer the rudder, but it is ultimately working with a powerful, unpredictable, and generative force.

The new agreement formalizes this strange and beautiful dance. OpenAI has committed to purchasing another $250 billion in Azure services, feeding the beast the computational fuel it needs to grow. But in a fascinating twist, Microsoft no longer has first refusal rights as OpenAI’s sole compute provider. And OpenAI can now jointly develop products with third parties. This isn’t about locking something down; it’s about giving it room to breathe, to connect, to evolve. Microsoft gains the right to pursue AGI on its own, but the core of the deal suggests they know the journey is better made together.

This is the creation of a new kind of entity, a hybrid of corporate structure and pure research, of human ambition and artificial intellect. Analysts fret about the current deal representing a $0.60 per share drag on Microsoft’s earnings. A drag! That’s like complaining about the cost of steel girders while you're building the world’s tallest skyscraper. This isn't a cost; it's the foundational investment in a completely new paradigm, and the fact that we can even quantify it on a balance sheet is frankly absurd. When you’re rewriting the rules of what’s possible, the old accounting methods start to look a little quaint, don’t they?

This moment feels like the early 20th century, when the pioneers of electricity, like Edison and Westinghouse, were building the grid—they weren't just selling light bulbs, they were building the circulatory system for the modern world, enabling everything that came after it. That’s what’s happening right now with Azure and OpenAI, it’s not just about chatbots or image generators, it’s about laying the cognitive infrastructure for the next century of innovation and discovery.

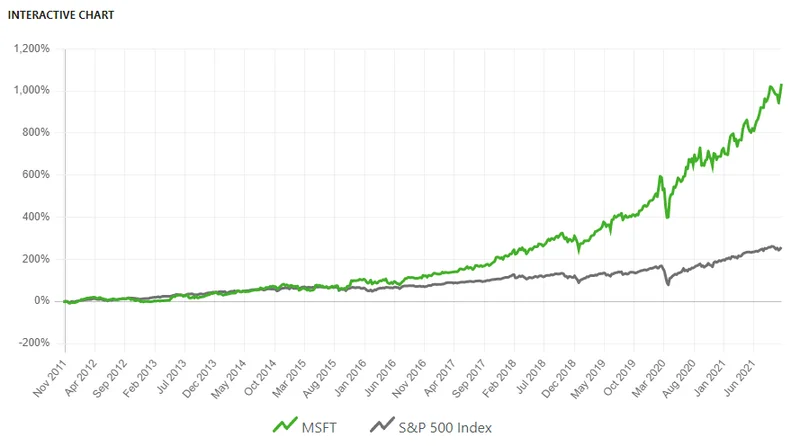

Of course, the market is reacting. The Dow, S&P 500, and Nasdaq are all hitting record highs, buoyed by the relentless optimism around AI. We see Nvidia’s stock soaring as its CEO declares the industry has "turned a corner." We hear chatter about Microsoft’s stock price, now hovering around $500, and whether its weight in the Dow necessitates a stock split to keep the price-weighted index in balance.

But these are just the tremors. They are the surface-level effects of a tectonic plate shifting deep beneath our feet. A stock split is a mechanical adjustment—in simpler terms, it’s just cutting a pizza into more slices so more people can get a piece. It doesn't change the size or the taste of the pizza. The real event, the thing that’s changing the recipe for civilization itself, is the deepening entanglement of human corporate ambition with non-human intelligence.

This deal gives both Microsoft and OpenAI incredible flexibility. It prepares them for a future where AI isn't just a tool, but a partner. The clause extending IP rights to post-AGI models, with verification by an independent panel, is our first real glimpse into the governance of the future. How do you contract with a mind that might one day be smarter than your own? How do you build safety and alignment into the legal DNA of your partnership from day one?

These are the questions that matter far more than quarterly earnings. This is the conversation we need to be having. We are moving from a world where we command technology to one where we collaborate with it. This Microsoft-OpenAI pact is the most significant, high-stakes, and financially binding collaboration agreement ever signed between our present and our future.