XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

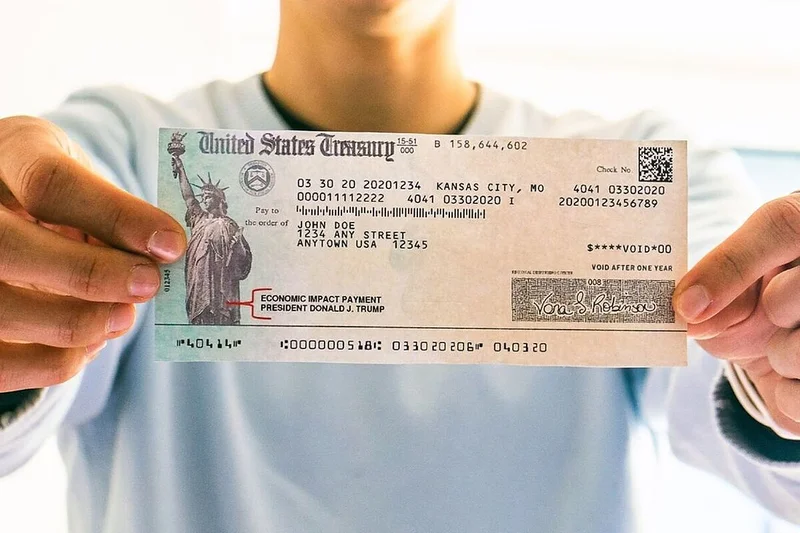

It seems like clockwork: every few months, the internet lights up with rumors of another stimulus check. This time, the supposed pot of gold is a $2,000 IRS stimulus payment, supposedly hitting bank accounts in November 2025. Before you start planning that early Christmas splurge, let's run the numbers and see what's actually going on.

The core claim is simple: a $2,000 direct deposit from the IRS, arriving this month. These rumors tend to spread like wildfire on social media, fueled by a mix of hope and, let's be honest, a lack of critical thinking. The IRS, however, has been quick to debunk these claims. No new stimulus or refund program has been authorized by Congress or the IRS itself. $2000 IRS stimulus check coming in November 2025? Here's the truth

The agency has issued warnings about phishing scams that prey on this very hope, promising "guaranteed payments" in exchange for personal or banking information. This is where things get dangerous. These scams aren't just annoying; they can lead to identity theft and financial ruin.

Digging into the past, we can see a pattern. The government issued three official federal stimulus checks during the pandemic: up to $1,200 per adult in the first round, $600 in the second, and $1,400 in the third (in 2021). The final deadline for claiming the third stimulus, or Recovery Rebate Credit, was April 15, 2025. Any unclaimed funds have reverted to the US Treasury. So, where does the $2,000 figure come from? It seems to be pulled out of thin air, or perhaps conflated with other state-level relief programs, like Alaska's Permanent Fund Dividend.

President Trump has floated the idea of using tariff revenue to fund taxpayer rebate checks, even mentioning a potential $5,000 "DOGE dividend." It's an interesting concept, but there's no concrete movement on this front. And even if it were to happen, the economic implications are complex.

According to JPMorgan Asset Management's chief strategist, David Kelly, the tax cuts announced as part of President Trump’s One Big Beautiful Bill Act (OBBBA) are retroactively effective from Jan. 1, 2025. However, the IRS won't be adjusting tax withholding rates in 2025. This means many taxpayers will pay more upfront and get a bigger refund in 2026. Kelly estimates the average refund could be roughly $3,743—up from the average refund of $3,186 for the previous tax year.

But here's the catch: these tax cuts aren't evenly distributed. "All of these tax breaks, with the exception of the child tax credit, are in the form of deductions," Kelly writes. "This means that the higher your marginal tax rate, the greater the value of the deduction." In other words, the wealthy benefit more.

Meanwhile, the Trump administration's decision to hike tariffs impacts all consumers. Tariffs in effect as of September, 2025, could cost U.S. households up to $2,400 on average, according to Yale’s Budget Lab. Unlike the OBBBA tax cuts, which can disproportionately impact higher income households, these import taxes have a greater impact on poor households because a larger share of their income is spent on buying essentials, according to the Tax Foundation.

The combination of tariffs and tax refunds could create economic conditions that are similar to the Covid pandemic, according to Kelly. "The big kicker here, that people are not talking about, is this huge rush of income tax refunds that’s going to kick in at the start of next year is going to be like an extra stimulus check," he said. "And we’ve seen what happens…you give an American consumer a stimulus check, they will spend it ... You are going to get a second round of inflation." While inflation is back at 3%, Kelly estimates it could rise back up to 3.5% by the end of the year. A tax-refund surge is coming, JPMorgan strategist says — and it’ll shift US economy like a new round of stimulus checks

So, what can you do to protect yourself from these scams? The IRS "Where's My Refund" tool remains the safest way to track your refund status. You'll need your Social Security number, filing status, and refund amount. Most refunds arrive within 21 days of acceptance via direct deposit. State refunds can be tracked through individual Department of Taxation websites.

Officials strongly advise avoiding third-party links or messages promising fast cash. Any request for bank details, fees, or personal data is likely fraudulent. Always confirm updates through official government websites and never rely on unverified social media posts. This might seem obvious, but the sheer volume of these scams makes it easy to slip up. (And this is the part of the report that I find genuinely puzzling – how do so many people still fall for these?)

The $2,000 stimulus check rumor is just that: a rumor. There's no evidence to support it, and plenty of evidence to suggest it's a scam. While larger tax refunds are coming in 2026, they're not free money; they're the result of changes to the tax code. And while a "DOGE dividend" sounds intriguing, it's still just talk. The real takeaway here is to stay vigilant, verify information, and don't fall for the promise of easy money.