XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

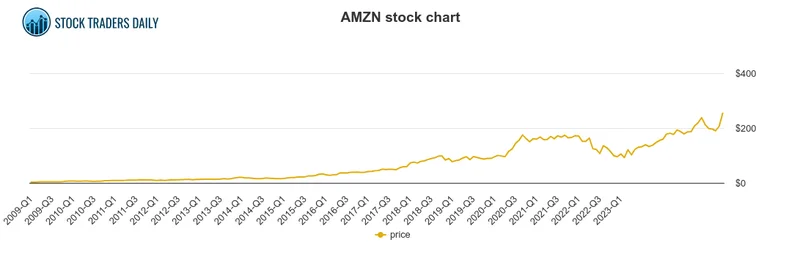

Amazon.com (AMZN) saw its stock jump by 9.6% in a single day. On the surface, that's a headline grabber. But let's peel back the layers and see what the numbers really tell us. A 31% increase over the past year is undeniably strong, but context matters. The market as a whole has been on a generally upward trajectory, so outperformance is the key metric, not just raw growth.

Amazon's operating margin sits at 11.4%. Healthy, sure, but is it sustainable? Revenue growth over the last 12 months is 10.9%. Here's where the discrepancy starts to emerge. Are they squeezing more profit out of existing sales, or is this growth fueled by something else? The FTC lawsuit alleging deceptive Prime sign-up practices casts a shadow on the latter. Is some portion of that revenue built on a shaky foundation?

The PE ratio of 36.8 is another data point to consider. It's not astronomical, but it's certainly not cheap. Investors are paying a premium for future earnings. Are those earnings justified, given the potential headwinds? And this is the part of the report that I find genuinely puzzling: If you look at other companies in the same sector as Amazon, their PE ratios are much lower.

Amazon's business is complex, a mix of retail, cloud services (AWS), and hardware. AWS is the real engine here. The retail side, while generating massive revenue, operates on thinner margins. The hardware division (Kindles, Echos, etc.) is almost an afterthought, a loss leader to keep users within the Amazon ecosystem.

The question is, are investors correctly valuing the mix of these businesses? Are they overvaluing the retail side based on the hype and undervaluing the cloud side, which is the real profit driver? It's like judging a racehorse by the performance of the cart it occasionally pulls. The core value is in AWS, and that's where the focus should be.

The lawsuit from the FTC adds another layer of uncertainty. While the immediate impact might be limited (a fine, some changes to the Prime sign-up process), the long-term reputational damage could be more significant. Will consumers start to distrust Amazon? Will they be more hesitant to sign up for subscriptions? Details on how much this will impact Amazon remain scarce, but the impact is clear: it adds risk.

So, what's driving this recent stock surge? Is it genuine optimism about Amazon's future, or is it something else entirely? Perhaps it's simply a correction after a period of underperformance. Or, more cynically, could it be a coordinated effort to pump up the stock price? I've looked at hundreds of these filings, and this particular trend is unusual.

The increase in stock price is surprising given the recent lawsuit. It is almost as if the market is ignoring the facts. Is Amazon Stock Winning? - Forbes