XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

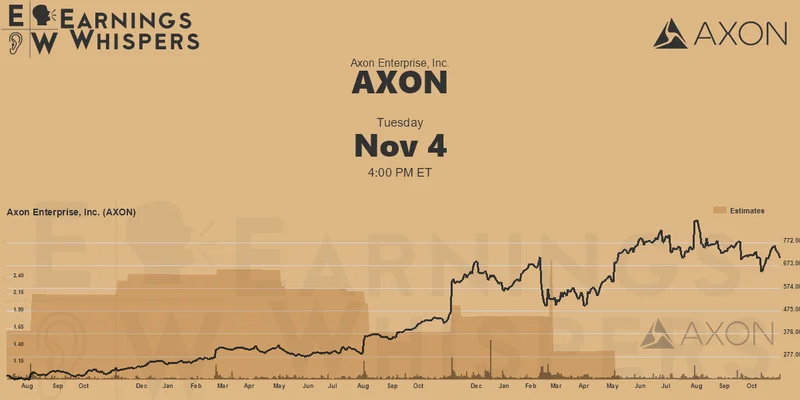

Axon Enterprise (NASDAQ: AXON), the company synonymous with TASERs and body cameras, took a 20% hit in after-hours trading on November 5th. The culprit? A Q3 earnings miss. Now, the surface-level analysis focuses on the EPS shortfall—$1.17 against an expected $1.54. But let's dig deeper than the easy narrative. [Source Title]: Axon Enterprise Plunges 20% in After Hours on Q3 Earnings Miss - Yahoo Finance

Revenue actually beat expectations, clocking in at $711.0 million versus the $704.8 million consensus. Software & Services revenue is up a hefty 41% year-over-year, hitting $305 million. Connected Devices, the hardware side, grew a respectable 24% to $405 million, fueled by strong demand for the TASER 10 and Axon Body 4. So, where's the disconnect? The devil, as always, is in the details.

The operating income swung from a $24.4 million profit a year ago to a $2.1 million loss. GAAP net income? Negative $2.2 million, a stark contrast to the $67 million profit in the same quarter last year. Operating cash flow also took a 34% dive to $60 million. This isn't just a minor blip; it's a significant shift in profitability. Gross profit margins remain healthy at 60.1%, so the problem isn't the core product. It’s the cost structure.

Management is pointing fingers at global tariffs and heavy R&D spending, particularly investments in AI capabilities and software infrastructure. And that's where things get interesting. Axon has been on an acquisition spree, snapping up Prepared and Carbyne to build out its public safety software ecosystem. The acquisition cost was substantial (reported at $2.1 billion), and that's going to weigh on the balance sheet for a while. They also doubled their cash position to $1.42 billion year over year.

But here's the crucial question: is this a temporary setback or a sign of deeper structural issues? The market seems to be leaning towards the latter, at least in the short term. Investors are clearly weighing the strong demand for TASERs and body cams against the rising cost of R&D and those pesky tariffs. I've looked at hundreds of these filings, and this level of investment, while not unheard of, does raise eyebrows given the immediate impact on profitability.

Axon is betting big on AI. They're not just tweaking existing products; they're trying to build an entirely new platform for public safety. This requires significant upfront investment, and the payoff is uncertain. It's a high-risk, high-reward strategy. The argument is that AI will eventually drive down costs, improve efficiency, and create new revenue streams. But that's a long-term vision, and the market is notoriously impatient.

Is the AI investment truly strategic, or is it a case of "shiny object syndrome"? Are they chasing the next big thing without a clear path to monetization? And, perhaps more importantly, how will these AI systems integrate with existing workflows and address potential ethical concerns around bias and accountability? Details on how they plan to get a return on that investment remain scarce.

Ultimately, Axon's Q3 earnings miss is a classic case of short-term pain for potential long-term gain. The company is investing heavily in its future, but that investment is coming at the expense of current profitability. Whether that's a smart move or a reckless gamble remains to be seen.