XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

So, Bank of America put out a press release.

Let me tell you, it was a real barn-burner. They’re declaring a dividend. A whole twenty-eight cents per share. Stop the presses. Alert the media. This is the kind of earth-shattering news that justifies the entire corporate communications department’s salary. It’s the financial equivalent of announcing that the sun will, in fact, rise tomorrow.

Except, buried beneath this mountain of non-news, a tiny little detail slipped out. A 25-year veteran, a guy who was basically part of the furniture, is walking out the door. And he’s not just retiring to a golf course in Florida. Nope. Kevin Brunner, one of their top M&A guys, is packing his desk, strolling across the street, and setting up shop at JPMorgan Chase.

But pay no attention to that. Look over here! Shiny dividends!

Let’s dissect the official statements, shall we? It’s my favorite blood sport. From Bank of America, on the departure of a man who has been with the firm (and its predecessor Merrill Lynch) since before most of today’s junior analysts were born? Crickets. A spokesperson “declined to comment.”

“Declined to comment” is corporate PR-speak for “We are screaming into pillows right now.” It’s the most honest thing a company can say, because it’s a complete absence of spin. They don’t have a good story. They can’t say “we wish him well” because they very clearly don’t. They can’t say “we’re excited for the new opportunities this creates” because they’re staring at a Brunner-shaped hole in their revenue stream. So they say nothing. The silence is deafening, and it tells you everything you need to know.

Meanwhile, over at JPMorgan, co-heads Filippo Gori and John Simmons are practically doing cartwheels in a memo, gushing that they are “delighted to welcome Kevin to our firm.” You can almost hear the champagne corks popping in the background. This isn’t just a hire; it’s a strategic poaching. It’s a power play. As JPMorgan snags BofA vet as investment banking chair - Banking Dive reported, JPM didn’t just gain a top banker; they took one from their biggest rival. It’s like the Yankees signing the Red Sox’s best pitcher. It’s a win for them and an equally massive, demoralizing loss for the other side.

This isn’t just a personnel change. This is a bad look. No, "bad" doesn't cover it—this is a five-alarm dumpster fire for BofA's reputation. A guy who advised on the $69 billion Broadcom/VMware deal and the $32 billion Google/Wiz deal doesn't just leave for a bigger paycheck. People at that level are already wealthy beyond comprehension. They leave for a reason. So what’s the real story? What’s so fundamentally broken inside Bank of America that a lifer decides the grass is greener at the cross-town enemy?

Everyone will tell you this is about money. And offcourse it is, partly. JPMorgan probably backed up a fleet of Brink's trucks to Brunner's house. But to believe it’s only about money is to be hopelessly naive. For a guy like Brunner, money is just how they keep score. The real game is about power, influence, and the freedom to actually get things done.

Leaving a firm after 25 years is like a divorce. It’s messy, it’s personal, and it only happens after years of accumulated frustration. You don’t just wake up one morning and decide to detonate your entire professional life. This was a long time coming. This signals a deep, structural rot. Maybe it’s the bureaucracy. Maybe it’s a clash with leadership. Maybe he saw the writing on the wall and realized the ship was heading for an iceberg. We don't know the specifics, but the action itself speaks volumes.

It’s like watching a master chef leave a legendary, three-star Michelin restaurant to go run the kitchen at the new, hot place down the street. He’s not leaving because he suddenly forgot how to cook. He’s leaving because the old restaurant’s management is running the place into the ground, stifling his creativity, or forcing him to use frozen ingredients. Brunner saw something at BofA that made him run for the exit, and you have to wonder how many other top players are quietly polishing their résumés. They want you to believe these guys are interchangeable parts, that the "firm" is all that matters, and honestly...

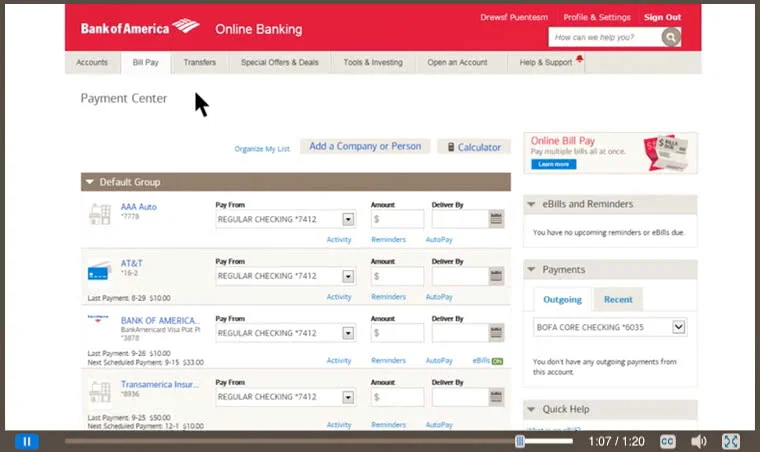

It reminds me of my own bank's app, which seems to be designed by someone who actively hates customers. It’s all part of the same disease: these institutions get so big and bloated they forget how to function. They become self-serving bureaucracies more focused on internal politics and meaningless dividend announcements than on actually winning. This ain't just about one guy leaving a bank; it's a symptom of a much bigger problem.

So while Bank of America is busy mailing out those $0.28 checks to project an image of calm, steady, boring reliability, their house is on fire. One of their star players just handed the playbook to their arch-nemesis. But don't worry, your dividend is safe. For now.

Let's be real. The dividend is a magic trick. It's the shiny object meant to distract you while the real story unfolds backstage. Bank of America lost a titan, a rainmaker who shaped some of the biggest tech deals on the planet, and their response is to talk about shareholder value. It’s an insult to our intelligence. The real shareholder value just walked out the door and into JPMorgan's corner office. This isn't just a news story; it's a warning shot. And BofA didn't even bother to fire one back. They just hid.