XLM Insight | Stellar Lumens News, Price Trends & Guides

XLM Insight | Stellar Lumens News, Price Trends & Guides

Alright, let's get one thing straight: the stock market is less a rational reflection of value and more a popularity contest fueled by hype and pixie dust. And right now, AI is the head cheerleader everyone's desperately trying to date.

So, offcourse, any company even tangentially related to AI is seeing its stock price skyrocket. Case in point: Lam Research. Up 117% this year? Give me a break.

They make chip manufacturing equipment. Equipment. Not even the chips themselves. It's like saying the company that makes the ovens for the bakery is the next big thing in the bread industry.

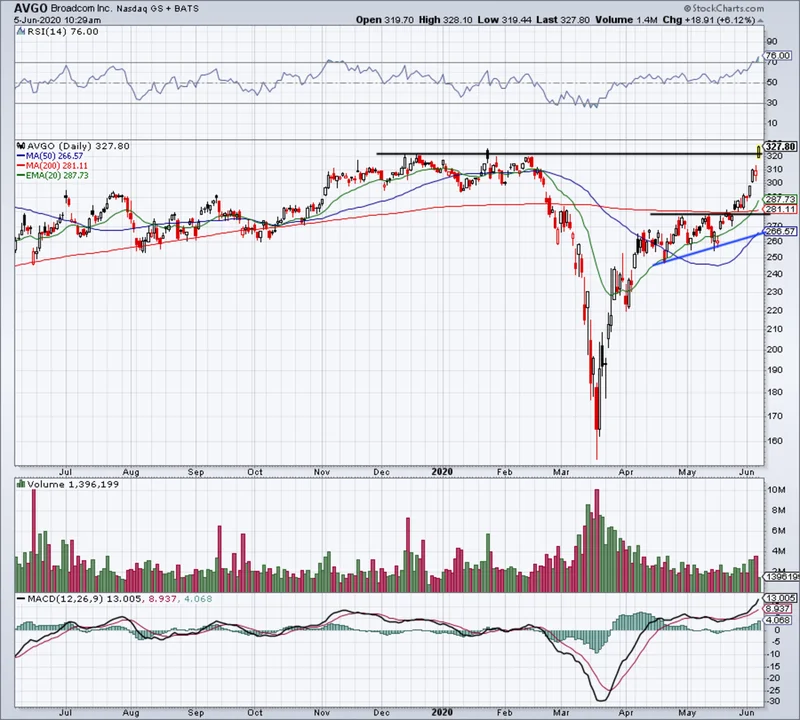

Nvidia and Broadcom are the obvious winners in the AI chip game, raking in cash hand over fist. No surprise there. But Lam Research? They're profiting from the promise of AI, the potential for growth, the dream of a future where every toaster and toothbrush has its own neural network.

The article quotes CEO Tim Archer saying AI-driven semiconductor equipment requirements "play extremely well to Lam's product strengths." Translation: "We're riding this AI wave all the way to the bank, baby!" I mean, can you blame 'em?

PwC estimates $1.5 trillion could be spent on new chip fabrication facilities between 2024 and 2030. Trillion! That's real money, even in D.C. But are we really going to spend that much? On chips? It sounds like someone is trying to create artificial demand to me, honestly...

And here's the kicker: Lam's addressable market expands by $8 billion for every $100 billion of incremental data center investment. It's like a damn pyramid scheme, but instead of recruiting your neighbors, you're selling them shovels during a gold rush.

Lam's Q1 numbers were good. Revenue up 27.5%, earnings up 46%. But that doesn't mean it's all sunshine and rainbows. The article mentions analysts are scrambling to raise their earnings targets. Why? Because they were wrong in the first place! It's a self-fulfilling prophecy. Analysts make predictions, companies try to meet those predictions, and everyone pats themselves on the back when it works out.

The stock trades at 33 times forward earnings. Supposedly, that's in line with the Nasdaq-100. But let's be real: the entire tech sector is overvalued right now. Comparing yourself to other overvalued companies doesn't make you a bargain; it just makes you less obviously insane.

And here's something else to consider: what happens when the AI bubble bursts? What happens when the hype dies down and investors realize that not every company with "AI" in its marketing materials is the next Apple? Lam Research's stock is gonna take a nosedive faster than you can say "dot-com bubble 2.0".

Look, Lam Research might be a decent company. Maybe. But its current stock price is based on pure, unadulterated hype. And hype, as we all know, is a fickle mistress. It's all fun and games until the music stops, and then someone's left holding the bag. And that bag is gonna be full of overpriced semiconductor equipment stocks. This Artificial Intelligence (AI) Chip Stock Has Crushed Nvidia and Broadcom This Year. It Can Still Soar Higher.

They're building castles in the sky and it's all going to collapse.